Fed decision: treasury impact summary – October 2025

This commentary follows the FOMC's update and is TreasurySpring's capital market experts, Henry Adams and Nigel Owen’s opinion, and does not constitute legal, investment, or other advice.

Rate decision

- Federal Open Market Committee (FOMC) voted 10-2 for a 25bp cut (1 vote for 50bp, 1 vote no change)

- Powell: December cut is "not a foregone conclusion"

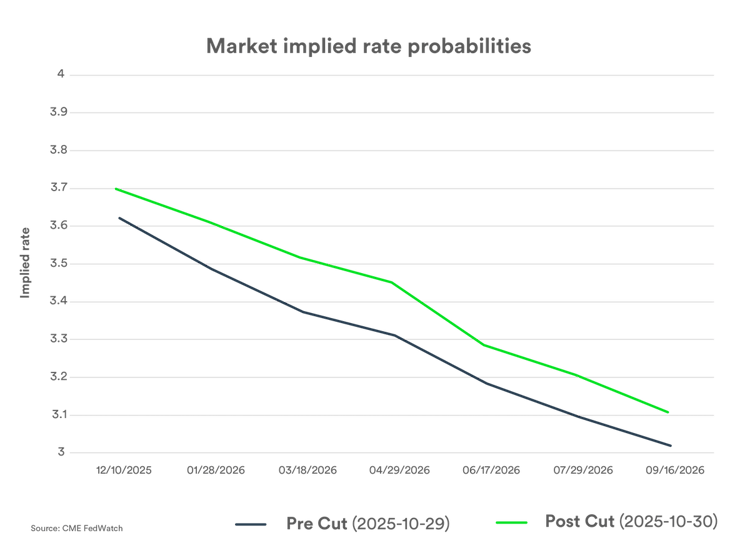

- Powell’s comments saw the market expectation of a cut in December drop from over 90% to below 70% according to CME FedWatch.

Watch on demand

What has changed since the last meeting?

The lack of data, particularly jobs-related, due to the US Government shutdown made a data-driven decision difficult.

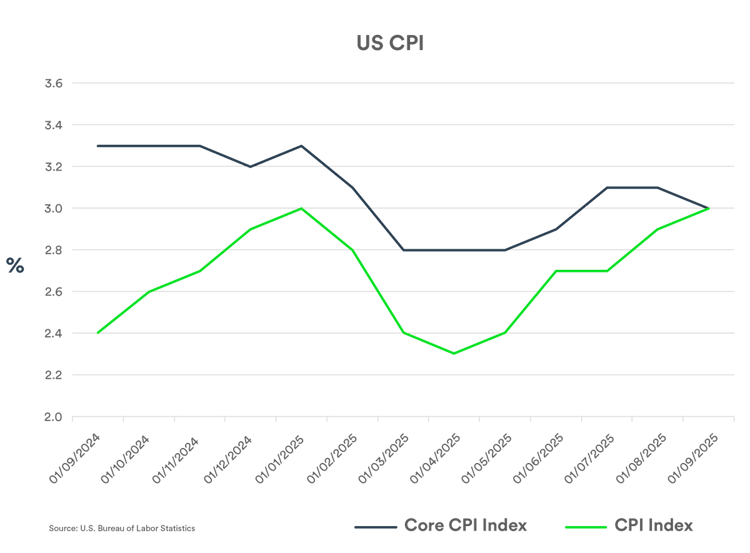

Inflation figures were lower than expected but still a high print for the year.

Sub-prime delinquencies and their knock-on effects have caused a few worries about the economy.

What has to be considered from here?

- What do consumer spending patterns look like? What can they tell us about the health of the economy?

- What does the backdated jobs data look like when it is released?

- Are sub-prime delinquencies contained or are their more bankruptcies and related bank writedowns to come?

- Has inflation peaked lower, or is it still going up, just more slowly? And should the Fed be cutting with inflation 50% higher than its target?

What is the market expecting?

Before October’s meeting, the market was confidently expecting a cut at both remaining meetings: CME FedWatch was showing 90%+. But Powell’s comments caused an almost instant repricing, not just for December’s meeting but across 2026‘s meetings too.

What to watch out for before December’s meeting

It is now a ‘live’ meeting – the decision is far from certain. Comments from Fed members, especially Governor Powell, should be watched closely amid the market noise. Treasury yields are likely to react to comments more while data remains scarce.

We may soon see some backdated jobs data – keep an eye on how those figures are tracking. Beware of sharp moves if a slew of data is released. Watch out for any rescheduled data release dates.

Turning to banks. Several of the large institutions have reported record profits and are moving upwards with the stock market rises. But regional banks haven’t been faring as well. Watch out for any further write-downs and ensure your cash remains well-diversified.

As we move from Halloween into the year-end period, consumer spending becomes a key focus. How much are households spending – and how are they spending it? Credit card balances have been climbing, so trends here will matter.

And finally, are there any more, to quote Jamie Dimon, “cockroaches” that emerge?

*TreasurySpring’s blogs and commentaries are provided for general information purposes only, and do not constitute legal, investment or other advice.