Who we work with

TreasurySpring helps private fund managers, big and small, surface value buried in the balance sheet – in one intuitive portal.

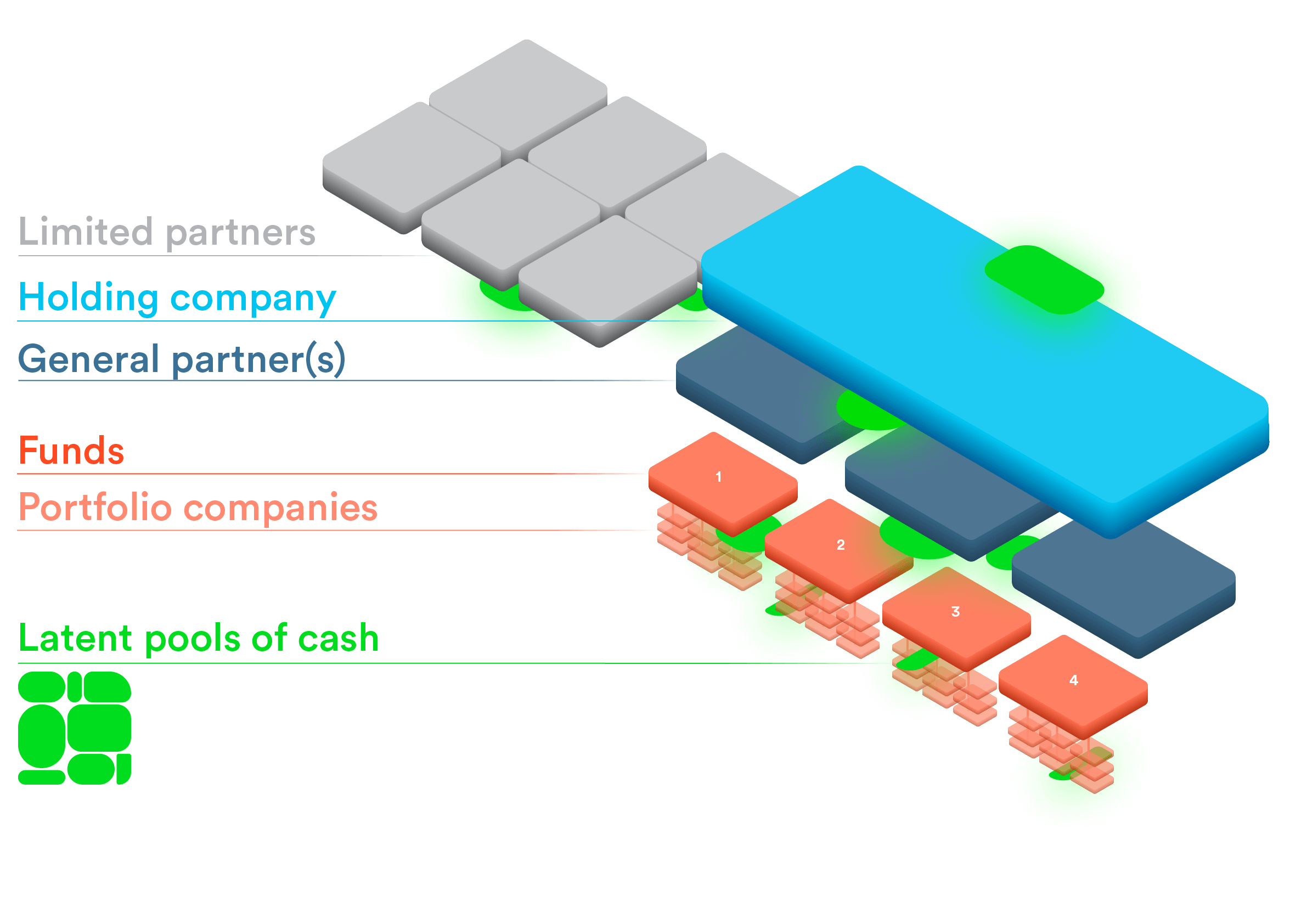

Unearth what’s hidden

Smarter cash strategy starts here.

Across the private funds ecosystem – from capital calls to carry, from management fees to distributions – cash is moving.

This is your invitation to see what lies beneath.

Surface: The overlooked asset

Surface is a deep dive into the underappreciated, underutilised, and often unseen pools of capital that sit idle across fund structures. It's essential reading for anyone unwilling to leave value buried in the balance sheet.

This isn’t just a strategy paper.

It’s a strategic tool for those who want to turn idle cash into a driver of fund performance.

Unlock the playbook. Surface the value.

Complex fund structures.

Simple cash strategy.

- 1000+ products in 8 currencies

- Terms from one day to one year

- Access secured investment products at the click of a button

- Designed to target better outcomes than deposits or money market funds

- 115+ investment-grade banks, governments and government agencies

- Choose your rate, term and obligor*

- Bankruptcy-remote, maturity-matched, and single-name exposure

- Structure your investments to support capital calls, semi-liquid structures, complex jurisdictions and more

- Platform onboarding in <72 hours for regulated or listed entities**

- Streamlined due diligence designed to easily add new fund entities

- Manage all entities via a single portal

- No new bank accounts or internal infrastructure needed

Our impact, in numbers

Private funds choose TreasurySpring to turn idle cash into a performance lever – without tech headaches or compliance complexity. From GPs to LPs, our streamlined platform is already trusted by hundreds across the industry. And we’re just getting started.

Small decisions. Big results.

private fund entities, LPs and GPs on the TreasurySpring platform (and counting)

trusted with TreasurySpring from private fund clients in last 12 months

yield earned for private fund clients in last 12 months

FAQs

1. Do I need to open a new bank account to use TreasurySpring?

No – there is no need for any new bank accounts or client infrastructure. All products are standardised and accessed through the same platform. TreasurySpring’s public API allows you to view and manage investments from within select existing treasury tools.

2. How long does onboarding take?

The onboarding is simple and fully digital. We can typically onboard regulated or listed entities in 48-72 hours. For fund structures, our simplified onboarding and streamlined due diligence means you can add subsequent related entities in weeks, not months.

3. In what jurisdictions can I onboard?

We can onboard any entity as long as it meets our regulatory and KYC/AML requirements. That means we are able to help private funds in complex regulatory environments, such as Luxembourg, the Channel Islands and the Cayman Islands.

4. Do I have any credit risk to TreasurySpring?

No – your credit risk is only to the underlying obligors that you choose to invest with. Client funds never touch TreasurySpring’s balance sheet and TreasurySpring has no ability to move any client funds. Client subscriptions are placed in segregated vehicles and all cash movements are conducted by the platform’s independent administrator. TreasurySpring only offers exposure to high credit quality governments, banks, and corporations. All obligors must be investment grade in order to be eligible for inclusion on the platform.

5. What obligors do you have on the portal?

At present we offer 115+ obligors and that number is continuously growing. All products on the platform offer exposure to investment grade issuers. These are organised across three core verticals: government (& SSA), bank, and corporate.

6. What term options are available on the portal?

Terms range from one day to one year. At present we have 1000+ cash investment products available on the platform every day across 8 currencies (GBP, USD, EUR, ZAR, CAD, AUD, NOK, and PLN), with new products and currencies being added frequently.

7. What does it cost?

Onboarding to the platform is completely free and there are no service charges or recurring fees. The indicative yields and maturity amounts displayed on the platform are always net of all fees and costs. There are no hidden or unexpected charges.

Surface a better strategy for your fund’s cash

TreasurySpring helps private fund managers, big and small, streamline processes, reduce risk and surface the value buried in their balance sheets – in one intuitive portal.

- Access the repo market without operational lift

- Select from 115+ counterparties, 8 currencies and 1000+ options

- Deploy idle cash in days, not months

- Maintain your current banking relationships

Designed to unlock the full value of your funds' cash.

Connect with our team today

See what lies beneath